Cellular IoT patent royalties: a closer look

A comparison of published rates underlines Sisvel Cellular IoT’s strong value proposition

By Sven Törringer

The Internet of Things will be critical to the cities, grids, farms and supply chains of the future, and there are numerous connectivity options for bringing it to life. As market data shows, the industry is increasingly gravitating towards solutions that operate on licensed wireless spectrum – including NB-IoT and LTE-M.

These technologies are open to all, but not necessarily free-to-use, which means companies need to consider patent licensing as they prepare their business cases. Fortunately, significant clarity regarding the royalty landscape is emerging.

A side-by-side comparison of the published rates from Sisvel Cellular IoT, which covers more than 30 patent portfolios, as well as those disclosed by major individual patent owners or other patent pools, can help device makers form a high-level picture of the licensing landscape. This exercise also demonstrates the Sisvel offering’s significant value proposition.

Please note: the information that follows in this article is illustrative only, comes from Sisvel alone and does not necessarily reflect the views of each patent owner involved in Sisvel Cellular IoT.

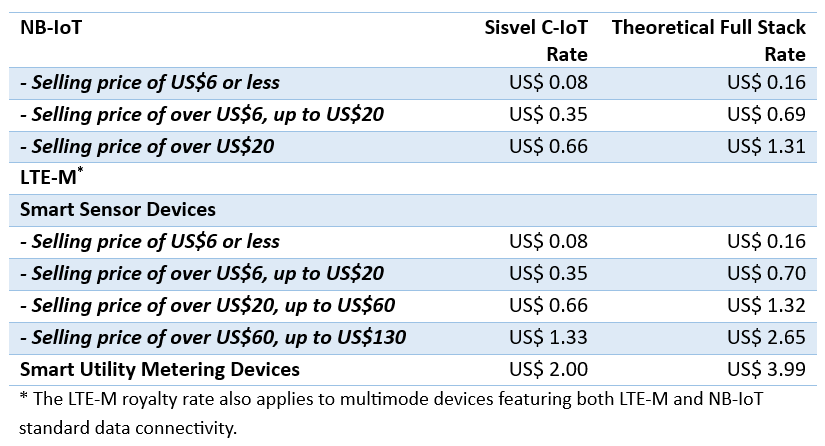

Sisvel Cellular IoT’s rates and patent coverage

Let’s start with Sisvel Cellular IoT’s rates, which range from US$ 0.08 to US$ 0.66 for NB-IoT devices and from US$ 0.08 to US$ 2.00 for LTE-M devices (detailed breakdown here and below).

The list of patent owners participating in Sisvel Cellular IoT, and the number of patents that they own or control, have increased significantly as the programme continues to attract new members. In fact, the number of patents the pool represents has more than doubled since its foundation – and it is still growing. An updated list of patent owners can be found at: www.sisvel.com/c-iot.

These rates provide access to many, but not all, of the relevant patents in these technology areas. Some patent holders, rather than joining a patent pool, may opt to exclusively license their patents directly and independently – or not to actively pursue any licensing of their patents at all.

To evaluate the pool’s value proposition, we need to make some assumptions about what share of the overall patent landscape the Sisvel Cellular IoT licence covers. Determining the exact representation of patent owners in the patent stack is notoriously difficult. The European standard setting organisation ETSI is currently the most detailed source of information about patent declarations in the field of cellular communication. It is, however, important to note that the information from ETSI is not perfect and that the ETSI databases are all based on self-declaration. There is no independent verification of the accuracy or completeness of the information, and there is a well-known situation with what some refer to as “over-declarations”. Despite these limitations, the ETSI database provides a reasonable benchmark to reference.

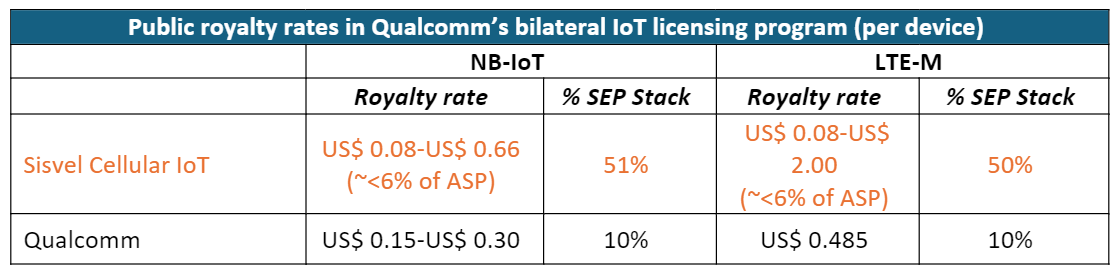

To do this, we enlisted an independent research firm to conduct an analysis of the ETSI patent declarations database, based on data collected up and until June 2023. The research firm, Dolcera, found that the Sisvel pool licensors account for 51% of the declared NB-IoT SEPs and 50% of the declared LTE-M SEPs relevant to user equipment.i

Sisvel Cellular IoT’s strong position in the SEP landscape is confirmed by an analysis of the standard development activity. For example, statistics show that the members of Sisvel Cellular IoT have been responsible for more than 50% of all relevant approved technical contributions to the NB-IoT and LTE-M standards.

You don’t have to take our word on this – there are various other third-party estimates in circulation, some of which assign Sisvel Cellular IoT an even larger share of the whole. Our analysis in this article, however, uses the Dolcera numbers.

So, what does the full stack look like? Well, if every patent owner outside Sisvel Cellular IoT offered rates equivalent to ours, in proportion to their calculated share of the total patent landscape, you would get the following theoretical full stack rates:

Put another way, if all patent owners adopted royalty rates comparable to Sisvel Cellular IoT’s, the cumulative royalty stack would represent, on average, below 6% of a device’s selling price.

That means Sisvel Cellular IoT operates at the bottom of, or even below, the royalty range established to be fair and reasonable by various courts worldwide for the full LTE standard (i.e. 6%-13.3%) in consumer electronics such as smartphones.ii That’s remarkably low if you consider the degree to which a smart sensor or smart meter derives its value from cellular connectivity (as opposed to smartphones with their much more wide-ranging technical capabilities).

Next, let’s see how these figures compare with other rates in the market.

Comparison with Qualcomm

According to its IoT licensing website, Qualcomm offers a licence covering devices with NB-IoT or LTE-M capabilities for 5% of the module purchase price, with no minimum. To unpack this, we need to look at publicly available market reports on module ASPs for these devices. When applying the ASPs from these reports to Qualcomm’s announced rates, they suggest an average royalty of US$ 0.485 for LTE-M devices, and between US$ 0.15- US$ 0.30 for NB-IoT devicesiii.

How do these stack up with Sisvel’s rates in terms of affordability? If every patent owner offered rates equivalent to Qualcomm’s in proportion to their share of the total patent landscape, that would yield a theoretical full stack rate of US$ 1.50 to US$ 3.00 for NB-IoT, and US$ 4.85 for LTE-M. Both figures come in above the high end of the range for Sisvel’s theoretical full-stack rates described above.

Comparison with Huawei

Huawei has also disclosed rates for its cellular IoT licensing programme. For IoT-centric devices, Huawei charges 1% of net selling price, capped at US$ 0.75 per unit for both NB-IoT and LTE-M. For IoT-enhanced devices, NB-IoT is charged at a flat US$ 0.30 per unit, while LTE-M is charged at US$ 0.50 per unit.

It’s important to note that Huawei is a Sisvel Cellular IoT pool licensor. The pool agreement replaces the bilateral royalties charged by Huawei and more than 30 other patent owners with a single low rate made possible by the pool's transactional efficiencies.

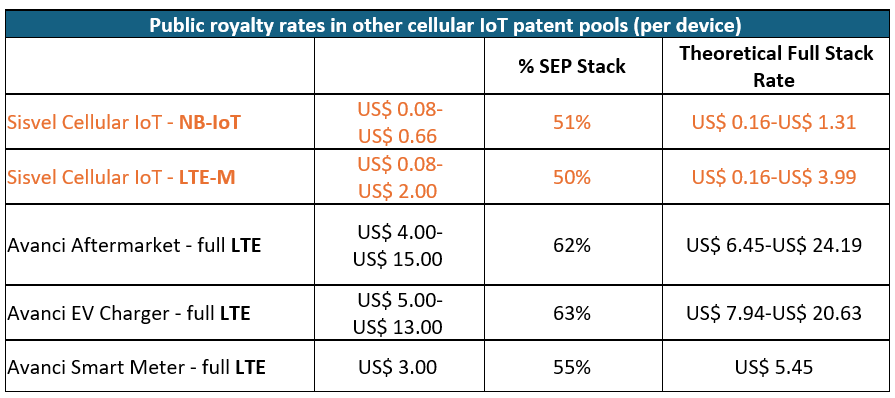

Comparison with IoT pools licensing full LTE

LPWAN technologies are not the only options for IoT connectivity – some companies opt to use the full LTE standard instead. This would put their products outside of the scope of the Sisvel Cellular IoT licence.

Avanci operates a number of programmes in the IoT space which license the entire LTE standard to devices that are generally higher powered compared to those for which Sisvel Cellular IoT is designed.

These programmes’ rates for full LTE, as well as the theoretical full stack rate, are set out in the table below.

There are a number of considerations for IoT device makers deciding whether to deploy full LTE cellular connectivity or an LPWAN technology. In general, the low-power subsets of the LTE standard, NB-IoT and LTE-M, are designed to be less costly. The figures above suggest the relevant patent licensing costs may also be lower for these technologies.

Because Sisvel Cellular IoT excludes products with full LTE capability, the Sisvel and Avanci rates above should not form part of the same royalty stack for such products.

A good deal

Considering all available data points, a licence to Sisvel Cellular IoT is not only offered on fair, reasonable and non-discriminatory terms, but also represents a good deal when the value of the licensed patents to the licensed devices are considered in light of well-accepted benchmarks.

It should also be noted that while it is crucial to provide adequate compensation to entities that have invested heavily in R&D to incentivise continued innovation to the benefit of all players in the ecosystem, Sisvel Cellular IoT has deliberately chosen not to set royalties at the high end of the reasonable FRAND range under this programme.

This decision is aimed to foster widespread access to and adoption of NB-IoT and LTE-M technologies across both current and future product industries. By participating in the pool, patent owners are effectively sacrificing a portion of the specific value associated with their patented technologies to promote broader acceptance and implementation of these cellular IoT standards through amicable licences.

In summary, Sisvel is driven by an unwavering commitment to fairly rewarding world-class innovators while fostering the adoption of the standardised technologies they help create by offering value to licensees. We are confident that the Sisvel Cellular IoT licensing programme successfully achieves these objectives.

Sven Törringer is the Sisvel Cellular IoT programme manager

---

i. All figures in this article relating to percentage ownership of the SEP stack come from a Dolcera study commissioned by Sisvel based on data obtained from the ETSI website up until June 2023.

ii. See e.g. Unwired Planet v Huawei [2017] EWHC 711 (Pat), TCL Communication Technology Holdings, Ltd v Telefonaktienbolaget LM Ericsson et al, No. 8:14-cv-00341 (C.D. Cal. 2017) and Oppo v Nokia (2021 Yu 01 Minchu no 1232), First Intermediate People’s Court of Chongqing Municipality).

iii. To obtain these figures, we applied the published 5% rate to Module ASPs as reported in publicly available market reports. Module ASP for NB-IoT are reported to range between US$ 3.00 in China and US$ 6.00 outside of China, module ASP for LTE-M are reported US$ 9.70 worldwide (Techno Systems Research, January 2024, 2023 Cellular Broadband Device & Module Market).