Solid Q2 sales growth across smartphones, tablets and PCs

Shipments were strong in multiple categories between April and June; many verticals are counting on AI features to sustain the growth momentum

By Jacob Schindler

This is the first edition of Sisvel Insights Market Data Digest, a regular feature that will aggregate commercial information from the major SEP licensing verticals. Our goal is to provide patent licensing executives with a grasp of the commercial and competitive dynamics in the market for connected devices. The digest exclusively draws on publicly-available information from third parties, all of which is available at its original source via links. Verticals with extensive data available such as smartphones will be covered every quarter. Other sectors will be covered as and when new data is published.

The second quarter delivered year-on-year growth across most connected device categories. One particular bright spot was the Chinese smartphone market, which is increasingly dominated by local brands. Sub-par consumer confidence in China has been a drag on many device markets for some time, so analysts are watching closely for signs that the country has turned a corner.

Elsewhere, annual data covering the IoT market in 2023 was published over the last two months and is summarised below. We also look at shipments of PCs and tablets worldwide. In the Wi-Fi space, meanwhile, we review the state of play and flag up a potential catalyst for Wi-Fi 7 adoption.

Cellular IoT: NB-IoT retains leading LPWAN market share

Three research organisations recently published data covering the 2023 market landscape for low-power wide-area network (LPWAN) technology.

Omdia declared NB-IoT the clear global LPWAN leader, based on its dominance in the Chinese market for smart meters and smart city solutions. There were around 700 million NB-IoT connections in 2023. LoRa, the closest rival with around 400 million connections in 2023, tops market share rankings in the rest of the world. Together, the two technologies accounted for 87% of all LPWAN connections last year. Omdia analysts predict NB-IoT will gain momentum in Europe this year and observed that newer entrants such as Wi-SUN and Mioty are gaining traction.

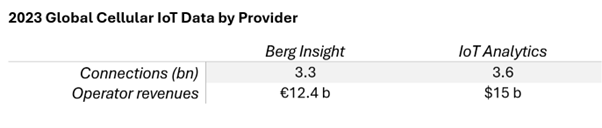

IoT Analytics published data on the global cellular IoT market in 2023. This includes not just LPWAN solutions like NB-IoT and LTE-M but also cellular technologies including LTE Cat 1 bis and 5G. The report found that 3.6 billion cellular IoT connections in 2023 generated $15 billion in revenue for mobile operators – with China’s big three telecoms as the top beneficiaries. A 23% increase in operators’ windfall contrasted with a 10% contraction in revenue for cellular IoT module vendors, which saw shipments decline in 2023.

A separate report from Berg Insights found similar figures for global cellular IoT connections and operator revenue, as shown below. It also forecast growth to 6 billion cellular IoT devices by 2028, generating €21 billion in operator revenue. The top Chinese operator, China Mobile, had a staggering 1.32 billion cellular IoT connections in 2023; the leading western operator was Vodafone with 184 million connections, followed by AT&T with 128 million connections.

Source data: Berg Insight | IoT Analytics

Wi-Fi upgrades in the works

Wi-Fi is on the cusp of a major shift as the publication of the final Wi-Fi 7 standard approaches.

According to IDC’s global forecast from last year, 4.1 billion Wi-Fi devices are expected to ship in 2024. While certification of Wi-Fi 7 compliant products has begun, the latest technology is available in a small share of products. IDC forecast Wi-Fi 7 to make up 5.7% of all Wi-Fi device shipments in 2024.

Other forecasts for 2024 from IDC included over 576 million shipments of Wi-Fi 6E devices (able to operate on the 6 GHZ unlicensed spectrum newly made available by many countries), 147 million Wi-Fi 6E access points and 23 million Wi-Fi 7 access points.

Some observers expect the first adoption of Wi-Fi 7 in an iPhone model to spur mainstream uptake of the next generation tech. The September launch of new iPhone models will be closely watched, as there is speculation that the iPhone 16 Pro will feature Wi-Fi 7 support.

While flagship smartphones will do a lot to boost next-generation Wi-Fi, the latest standard will take quite some time to filter down into applications like vehicles, as explained in a recent Sisvel Insights article.

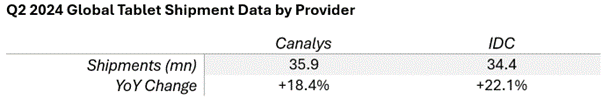

Tablets enjoy breakout quarter

Global tablet shipments grew by around 20% in Q2, reaching over 34 million. Analysts believe the strong quarter is a sign that the market is resuming a stable growth trajectory following the anomalous pandemic sales boom.

Apple commands this segment with its iPad lineup and it continues to push the boundaries at the high end with technologies like OLED screens. Chinese players Huawei and Xiaomi are growing fast – and expanding the category by promoting lower-cost offerings in China and other key markets.

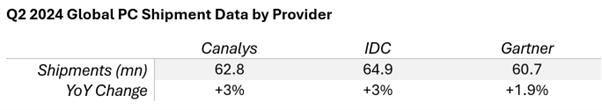

PC market braced for AI impact

The PC market had a positive Q2, with over 60 million shipments of laptop and desktop computers globally. According to IDC, worldwide shipments excluding China grew 5% year over year.

The consensus top four in the market are Lenovo, HP, Dell and Apple. IDC and Gartner have Acer in fifth spot, while Canalys awards this to Asus. Both Taiwanese companies came on strong in Q2, posting double-digit growth.

Hopes are high for PCs integrated with AI capabilities to shake up the segment. Attention will be focused on Qualcomm, Intel and AMD as they roll out chips to power these machines. In addition, Microsoft will end support for Windows 10 in October 2025, which should continue to drive enterprise demand over the next year.

Source data: Canalys | IDC | Gartner

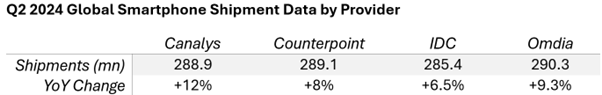

Global smartphones: Recovery gains momentum

The overall smartphone market saw solid year-on-year growth for the third consecutive quarter, building momentum for a recovery in 2024.

IDC, which reported the lowest growth figure of the major data providers (6.5%), cautioned that demand has not fully normalised, while there is still weakness in many geographies. It also noted increasing price polarisation, with ultra-premium and low-cost models squeezing out mid-range devices. Nevertheless, ASPs continue to increase and analysts expect generative AI to be the next big upgrade driver as it is increasingly integrated into premium handsets.

Canalys had the sunniest read on Q2, reporting 12% annual growth in shipments. But it warned that mobile phone makers will grapple with higher component costs in the second half of 2024, making double-digit growth unlikely on a full-year basis.

Samsung was the top vendor by shipments in Q2 with over 53 million units. Apple trailed by around 8 million units, while third-place Xiaomi is steadily closing the gap with the iPhone maker. Oppo, Vivo and Transsion are clustered together in the second tier, each with 25 to 26 million units.

5G-capable handsets accounted for two-thirds of all shipments in the first half of 2024. According to Counterpoint, devices above $400 are uniformly 5G-enabled, while no smartphones under $100 (which comprise around 16% of shipments globally) are equipped with 5G chipsets. Most of the market falls between these two price points and remains a mixed bag. In sum, although 5G is yesterday’s news in most advanced economies, it still has plenty of room for growth in Latin America, India, the Middle East and Africa.

Source data: Canalys | Counterpoint | IDC | Omdia

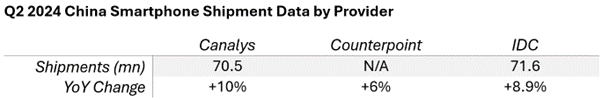

China smartphones: Local brands lead the way

It was a watershed quarter for Chinese smartphone makers. Apple fell out of the top five, conceding the field to a quintet of domestic brands: Vivo, Huawei, Oppo, Honor and Xiaomi.

Persistently weak consumer sentiment has been a drag on the smartphone market in China, but Canalys saw Q2 as a turning point, with the country “finally aligning with global recovery speeds”. Year-on-year growth estimates ranged from 6% to 10%. In IDC's data, the China market grew faster than the global baseline.

Vivo claimed the overall top spot with around 13 million shipments in Q2. Huawei was the fastest riser, with year-on-year improvement of 40%-50% per various analysts. Oppo, Honor and Xiaomi rounded out the top five. Competition among the Chinese brands will remain tight in the second half, with various AI product launches and the debut of Huawei’s new operating system set to drive purchase decisions.

Source data: Canalys | Counterpoint | IDC

India smartphones: Xiaomi back on top in slow quarter

Analysts agreed it was an underwhelming quarter for Indian smartphone sales. Extreme weather in some regions and other seasonal factors were blamed for what was variously observed as 1% growth (Canalys) or a 2% retreat (Counterpoint) year on year.

Growth is better, however, when focusing on premium models. A record-high 77% of shipments were 5G-capable devices, according to Counterpoint. The ultra-premium price segment, comprising handsets over 45,000 INR ($540), grew 24% year over year.

Xiaomi is benefitting from a focus on flagship models and has re-captured the consensus top seller position, edging Vivo. Although Samsung slipped to third place in terms of pure volume, Counterpoint has it as the top player when accounting for device value, with a 24.5% market share, followed by Vivo (16.8%), Apple (16.3%), Xiaomi (10.8%) and Oppo (10.1%).

One early Q3 development looks likely to give the premium smartphone market a further boost: the Indian government announced plans to cut customs duty on mobile phones from 20% to 15% as part of its 2024 budget. According to Canalys, this will create opportunities for Apple and high-end Android brands to drop prices.

LatAm smartphones: Fierce competition drives ASPs lower

Canalys published a report on Latin America smartphone shipments, which saw a third consecutive quarter of 20% annual growth. Motorola is the #3 player in this market, showcasing the Lenovo-owned brand’s regional strength. But it was passed during the second quarter by Xiaomi, which is zooming ahead in multiple geographies around the world. Hot competition among OEMs, Canalys analysts noted, drove the ASP to its lowest level since 2021.