Patent Pools: Startup and Patent Analysis

The previous two articles in this series detailed what a patent pool is and how they are formed. This article will describe the startup phase and patent verification activities.

The Inventive Loop

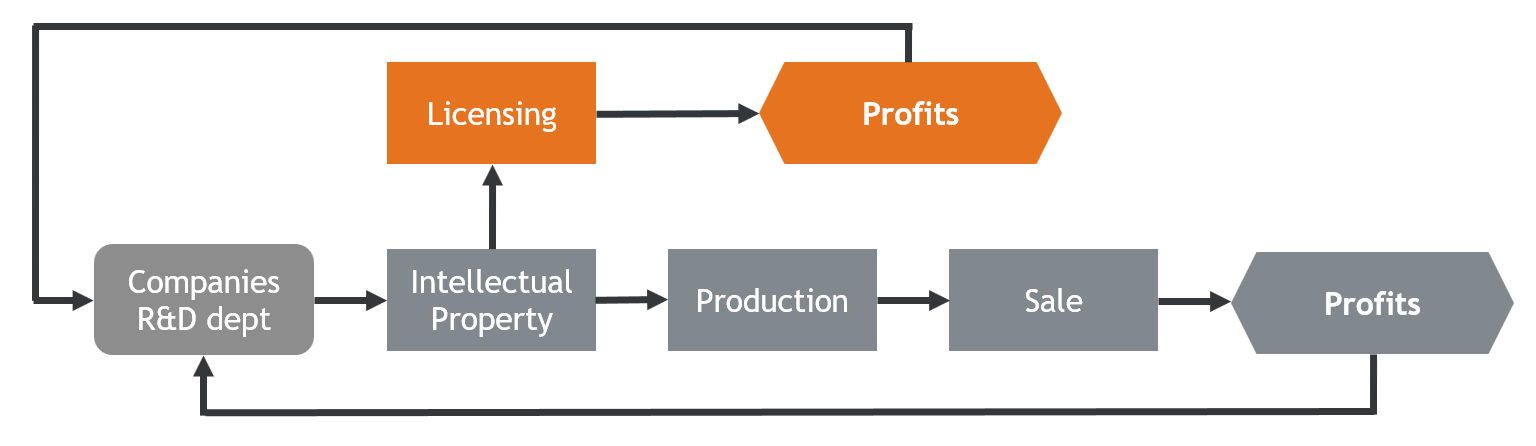

At this point, it’s instructive to take a step back and review the Inventive Loop (Figure 1) that patent pools and other licensing activities enable. As you can see in the Figure, companies invest in R&D and create inventions that they can license to others, integrate into their own products, or both. Profits from product sales and royalties are plowed back into R&D to fund future inventions.

Figure 1. The inventive loop.

Of course, the overall picture is much more complicated than Figure 1. As an example, consider the mobile phone. As of October 2012, one resource claimed there were over 250,000 cellphone patents in existence, a number which surely has risen since then.

The complex patent landscape in the technology industry has three key implications. First, as products become more complicated, it becomes impossible for any single company to develop all technologies needed to make them run. Patent pools, or another form of patent aggregation, are essential.

Second, these innovations will come both from practicing entities that build products containing their inventions, and non-practicing entities, like pure research organizations, universities, and others, that invest in their own R&D or purchase IP from other companies solely to generate licensing revenue. Finally, and most important, is that in order for the next smartphone to be produced, this R&D must be funded.

To put numbers to this analysis, by one estimate, most companies invest over a million dollars in R&D for each patent that they file. Obtaining coverage in the US, EU, and Japan for a single patent family can cost around $100,000. Recouping these investments in R&D and legal to enable future innovation is one of the main reasons why patent pools exist.

The Business Track

As mentioned in a previous article, patent pools generally start with a call for patents relating to the technology covered in the pool, and licensing initiates after an initial patent list has been published. The effort in between involves two distinct tracks that both require significant time and investment.

Patent pools generally take between 12 to 36 months for the patent owners to come to terms and compile and publish the initial patent list. During this period, the licensing administrator recruits new patent owners and manages the pool formation process while existing patent owners negotiate the pool agreement deciding upon key business issues like royalty rates, distribution allocations within the pool, and the like. There are employee costs for both the licensing administrators and patent owners and travel costs to the developer’s meetings.

These costs add up. In their article, Measuring the Costs and Benefits of Patent Pools, the authors spoke with the licensing administrators for two prominent patent pools and ascertained data like the number of patent owners and patents in the pool plus the number of formation meetings. From this, they were able to estimate the salary and travel/lodging expenditures for each pool. For one pool with 14 patent owners, the estimated cost was about $2.3 million. For another pool with 32 patent owners, the estimated costs was $4.8 million.

To be clear, these costs do not include the R&D costs associated with the invention, or the legal costs to patent it.

These are just the costs related to the pool formation.

The Patent Verification Track

The second major expense incurred by patent pools is external patent examination fees. That is, many pools engage third-party patent experts for each jurisdiction to examine the patents submitted by patent owners to determine if the patent is essential to the technology addressed by the pool. There are several reasons for incurring this expense.

First, antitrust guidance regarding patent pools provides that using independent experts to assess the essentiality of patents mitigates the potential anti-competitive impact of a pool, reducing the risk of antitrust issues. For example, in the United States, see this DOJ Letter. In the European Union, see paragraph 256 of this article in the Official Journal of the European Union.

Second, at some point, many patent pools may end up in court where they must defend the validity and essentiality of their patents. Including weak patents in the pool increases the cost of this litigation and may increase the likelihood of a negative verdict.

Whatever the motivation for the third-party review, it’s quite expensive; in the Measuring the Costs article cited above, the authors quoted a price of $7,500 for each patent, which they stated was a “bulk discounted rate.” So, gaining third-party essentiality reviews for a modest pool with only 100 submitted patents could easily cost $750,000 or more.

Note that Sisvel has over a dozen engineers on staff to vet the patents before the third-party review, eliminating patents that clearly don’t apply and creating documentation to streamline the third-party review. While this generally accelerates the patent review process it also increases the overall cost of pool formation.

Summary

Patent pools help to support the inventive Loop and fund innovation. Patent owners and patent license administrators invest substantial time and resources to form the pool and verify the essentiality of the included patents. Only after all this work has been done can the pool publish the patent list and begin the licensing process.