Sisvel’s DVB-T2 Patent Pool: How Successful Pools Accelerate Market Adoption

All patent pools launch with high aspirations and lofty goals. Most achieve modest success, while some fail outright. Others achieve spectacularly.

This case study presents the history of Sisvel’s slow starting but ultimately very successful DVB-T2 pool. Along the way, we explore how to measure a pool’s success and the factors that patent pool administrators and licensees within a pool can control that will help promote the pool’s success.

Let’s start with some background information about what DVB is and how patent pools operate.

ABOUT DVB

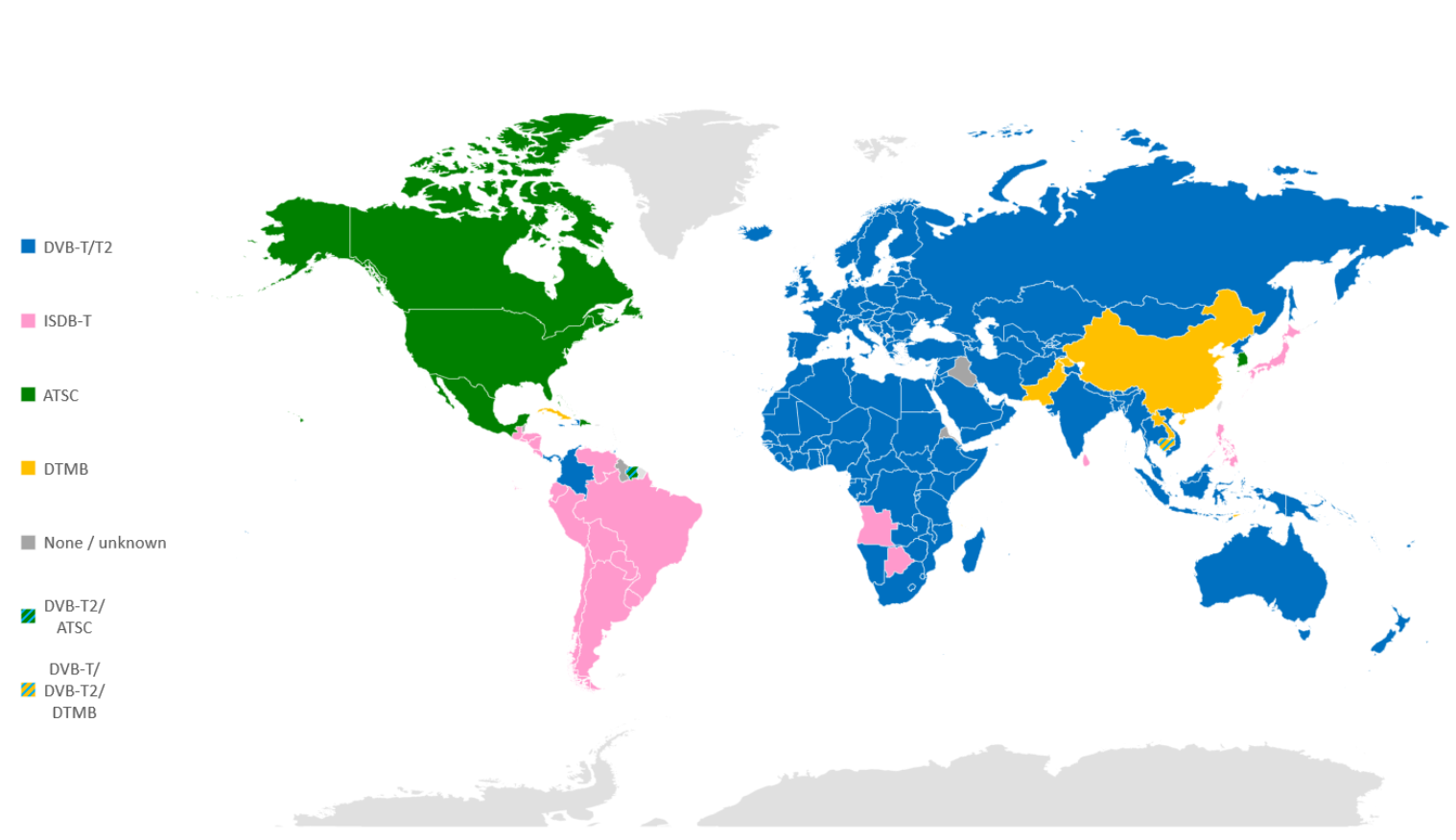

DVB stands for Digital Video Broadcasting, and in general, DVB defines a set of standards involved in distributing digital television via satellite, cable, and terrestrial broadcasting over the blue geographic regions shown in Figure 1. Collaborative development towards the DVB standards began in 1991 with the first standard released in 1994, with separate specifications for DVB-T (terrestrial), DVB-S (satellite), DVB-C (cable), and other elements.

Figure 1. DVB is the relevant standard for digital broadcasting in all blue areas on the map above.

ABOUT PATENT POOLS

As the name suggests, patent pools are groups of patent holders that own patents relating to a particular technology or standard, like DVB-T or DVB-S. These owners collectively agree to license their patents to companies that want to build products that utilize these technologies. Owners work with a patent pool administrator like Sisvel to set royalties and other business terms, and the patent pool administrator handles all licensing operations.

At their best, patent pools benefit both patent owners and implementors. Implementors gain the ability to enter a market without the time and expense of foundational R&D (as opposed to product-related R&D) and can acquire patent rights from multiple parties through one efficient agreement.

Patent owners get royalties for the use of their technologies, which typically funds new innovations that enable future generations of the standard and related products, benefitting society as a whole. They also get to leverage the manufacturing and distribution expertise of licensees to expand the market much further than possible had the patent owner group been the sole implementors. For more on patent pools, see here and here.

Patent pools typically exist through the effective life of the covered patents. At times, patent owners decide to leave the pool and offer their patents directly to implementors. While licensing terms are almost always set when the pool is launched, sometimes the patent owners and administrators change the terms to improve performance or welcome new patent owners.

GAUGING POOL PERFORMANCE

Patent pool administrators seldom, if ever, disclose licensing revenue or other direct measures of pool performance. However, one can gauge pool performance via publicly available data such as:

The performance of the underlying technology - Simply stated, the pool exists to support the success of the underlying technology. If that technology doesn’t achieve significant penetration in relevant markets, it’s challenging to call the pool a success.

The percentage of implementors that are licensees - No pool licenses all implementors; companies enter and leave markets all the time, and implementors can number in the hundreds or even thousands. But the higher the percentage of licensed implementors, particularly the larger implementors with the greater market share, the greater the revenue back to the patent owners.

Higher penetration also means a more level playing field for licensees, who are, in effect, sharing the cost of the foundational R&D, which adds to their costs of goods. The playing field isn’t level if some implementors pay royalties and others do not. A higher percentage of licensed implementors also speaks to the overall fairness of the licensing terms, and the success of the pool administrator’s licensing and enforcement efforts.

The percentage of truly essential patents that are represented in the pool and that are otherwise actively licensed. This is both an indicator of performance and a contributor to performance. In general, when a pool includes a higher percentage of the truly essential patents that are actively licensed by patent owners and that cover the technology, it means that the proposed licensing and other terms make strong economic sense to the patent owners who have joined the pool. It also means that the pool provides greater benefits to implementors by reducing administrative and often overall royalty costs, which makes the licensing agreement more palatable and easier to consummate.

By contrast, the lower the share of truly essential and actively licensed patents in the pool, the greater the likelihood that there are other patent holders or pools with more patent rights that implementors will choose to deal with first. This delays revenue, increases licensing costs, and can force costly litigation.

Retention of pool members. When patent owners leave a pool, it signals their dissatisfaction with pool performance, and that they believe that they can achieve a better return by licensing directly. Conversely, if a pool member returns to a pool, it means that the grass wasn’t, in fact, greener on the other side of the fence.

With this as background, let’s explore the history of Sisvel’s DVB-T2 and related pools.

SISVEL and DVB-T/DVB-T2

The first DVB-T pool was founded by MPEG LA in July 2001 and transferred to Sisvel in August 2008, which quickly allowed for a stronger penetration and an uptake in royalty revenues. At the time of the transfer, there were four pool members, France Télécom (now Orange), TDF SAS, Matsushita Electric Industrial Co., Ltd (now Panasonic Corporation), and Victor Company of Japan, Limited (JVC), with KPN joining the pool in January 2008.

As a technology, DVB-T was very successful. In the covered geographic regions, DVB-T was the first digital technology that succeeded analog TV and ultimately become the “most widely used digital television standard in use around the globe for terrestrial television transmissions.”

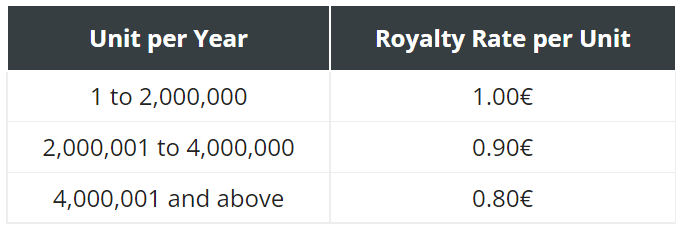

The success of DVB-T led to DVB-T2, which was standardized in June 2008 and first commercially deployed in 2009. Sisvel announced the DVB-T2 pool on September 9, 2010. At the launch, the pool had six members, including users like the BBC, Orange (formerly French Telecom), and Nokia. LG joined the pool soon thereafter. Initial pricing is shown in Table 1.

Table 1. Initial pool pricing for the DVB-T2 technology.

SLOW GOING

As the first terrestrial digital broadcasting technology, DVB-T proved remarkably enduring and the transition to DVB-T2 proved slower than expected, and patent owners Nokia and LGE left the pool. In late 2017, Sisvel proposed important changes to its terms and conditions that it felt would accelerate the program. The remaining patent owners supported the new terms, which were announced in May 2018. Relevant changes included:

A reduced royalty for consumer products with either an encoder or decoder, but not both (€ 0.75). The rate for a product with both encoder and decoder remained at € 1.00.

Introduction of royalties rates for professional products with encoders (€ 18.00), decoders (€ 18.00), or both (€ 24.00)

A reduced royalty for compliant licensees (20% discount for consumer products and 17% discount for professional products).

To encourage rapid adoption, Sisvel included “Early Bird conditions” that further reduced the licensing cost for companies signing a DVB-T2 license agreement for professional products within six months of receiving a notification letter from Sisvel and no later than Dec 31, 2018.

Please refer to the Sisvel website for current pricing.

Along with the new pricing was a strategic vision to target large implementors with patent portfolios, both as licensees and to join the pool as licensors. The key message to these implementors was that by adding their patents to the pool, they would simplify the licensing picture for new implementors, generate a return on their innovation, reduce administrative and royalty costs for implementors entering the market, and greatly accelerate the market development of the DVB-T2 technology.

AN OVERNIGHT SUCCESS - 8 Years Later

The market responded. Over a span of 5 months, Sisvel signed agreements with major manufacturers like Samsung, LG Electronics, and Sony, both as licensees of the pool, and licensors within the pool. In fact, Sisvel added all the remaining companies that contributed technology to the DVB-T2 standard. This totaled more than 1.700 essential patents from over 60 countries owned by ten patent owners, including the BBC, DTVG Licensing, ETRI, Fraunhofer, IMT Atlantique (formerly Telecom Bretagne), LG Electronics, RAI, Samsung, Sony, and TDF. This makes the pool a true one-stop-shop for all patents necessary to implement a product incorporating DVB-T2 technology.

Figure 2. Samsung joins the Sisvel DVB-T2 pool as licensee and licensor.

Without question, these patents added very significantly to the overall value delivered to pool licensees. However, acting upon Sisvel’s strong recommendation, the patent owners decided to focus on accelerating market development and not to increase the pool licensing cost.

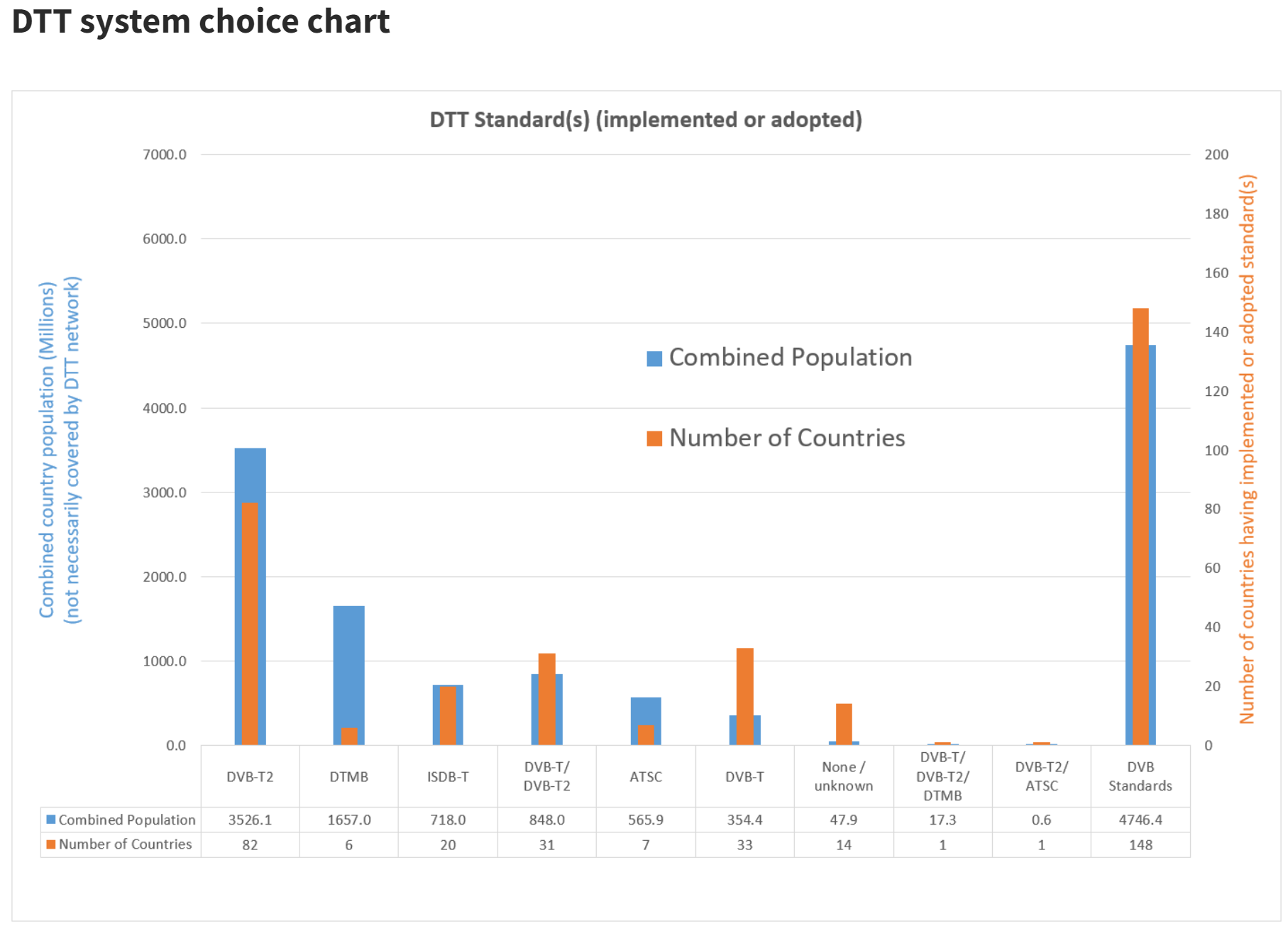

The impact was dramatic. To date, more than 195 companies have been licensed. This includes top TV manufacturers like LGE, Sony, Panasonic, Samsung, TPV, and Vestel, and set-top box manufacturers like Arcadyan, Netgem, Sagemcom, Strong, Technicolor, Technisat, Telestar, Telesystem. Negotiations with other companies are also at an advanced stage. Most importantly, as shown in Figure 4, DVB-T2 overtook DVB-T as the dominant terrestrial technology, accelerating the patent owner's return on investment.

Figure 3. DVB-T2 overtakes DVB-T as the dominant terrestrial technology (from here).

THE WORK CONTINUES

It’s unfortunately difficult to tell a story about a patent pool without mentioning litigation. Despite the worldwide recognition of the pool’s validity, there are some implementers that refused to take a license. For this reason, some members of the Sisvel’s DVB-T2 patent pool filed litigation - inter alia - in Germany enforcing some patents of the pool against Hisense and TCL Technology, two Chinese multinational electronics companies. Those cases came to settlement before being adjudicated, confirming once more the strength of the DVB-T2 pool. More actions against other unwilling companies are also under preparation.

To create a level playing field, when negotiation fails or is constantly delayed by “hold-out” tactics, litigation remains the only tool available against companies engaged in any kind of efficient infringement. Litigation is not only in the best interest of patent owners, who need to monetize their IP assets to recoup the huge investments made in R&D but also of all the willing licensees who honestly took a license.

A SUCCESS BY ANY MEASURE

By any measure, the DVB-T2 pool has been a resounding success. DVB-T2 became the dominant terrestrial technology, the pool signed a dominant majority of implementors of DVB-T2 technology, and the pool now represents 100% of DVB-T2 related patents. And, yes, LG Electronics rejoined the pool, as did the DVB-T2-related patents of Nokia, which were acquired by Samsung and added to the pool with Samsung’s other related patents.

Not surprisingly given this success, Sisvel’s participation with DVB expanded to cover most licensing programs offered by the European standards body as shown in Figure 4. This makes a lot of sense, of course, since many of both the patent holders and implementors are the same for multiple pools.

Figure 4. Sisvel is the patent administrator for most DVB licensing programs (from here) including DVB-SIS.

KEY TAKEAWAYS

What are the key takeaways from this? What lessons can patent pool administrators and patent owners take from this story? There are many, but here are some key ones.

A Critical Mass of Patents is Fundamental to Pool Success

It’s not always possible to accumulate 100% of the truly essential patents for any covered technology; in fact, this is the exception, not the rule. That said, when key implementors join the pool, it helps legitimize the license offering and accelerate licensing of other large and smaller players.

Many technology standards are dominated by a small number of major patent owners that license directly, and then a number of companies that own good essential patent portfolios and that are willing to offer the market the efficiencies stemming from the creation of pools. A single pool comprised of these companies offers a strong value proposition and a critical mass that can’t be ignored.

Depending on the market and the concrete conditions, what constitutes critical mass varies: in particular, if there are several patent owners who do not actively license their patents or are not willing to enforce rights to maintain a level playing field, critical mass can be represented by those patent owners who are willing to defend the rights of licensors and licensees.

Multiple pools in the same technology, however, not only offer less value but also generate a negative dynamic where implementors cannot chose one or the other, ignore them both or worst, use the existence of the other pools to hold-out. The risk is not merely theoretical, it is very much a real-life issue: this has been demonstrated in the licensing of standard essential patents in video coding and in particular in H.265. It took time and litigation to clarify the situation and see substantial endorsement of one pool.

Licensing Terms Must Focus on Long Term Market Success

If the technology doesn’t succeed or underachieves in the marketplace, the patent owners' return on their R&D investments may not be fully realized. For this reason, licensing terms should accelerate widespread technology adoption rather than the hope of short-term revenue gains.

Licensing terms are not a “one-size-fits-all” operation; even from one technology generation to the next, terms may need to be customized to maximize success. In addition, some flexibility should be built into licensing terms to facilitate negotiations.

Experience Matters

When choosing a patent pool administrator, familiarity with the market and key implementors and recent successes are absolutely critical to crafting the optimal business terms (and pivoting when necessary). In particular, an administrator with previous success in signing licensing agreements with key implementors will have a relationship that will accelerate all phases of the licensing workflow.